tax abatement definition for dummies

A city grants a tax abatement to a developer. Whether revitalization efforts will ultimately prove successful is a big question mark.

What Is Abatement Definition And Examples Market Business News

While governments offer these incentives as a tax break or property tax abatement to improve the local economy it doesnt always work.

. Tax abatements help reduce the initial costs of opening a business. The reduction or elimination of taxes. This annual expense does not disappear when the mortgage is completely paid.

It represents part of the ongoing cost of owning a home. The word abate means to reduce in value or amount So a tax abatement is simply a lessening of tax. A tax abatement is when a taxpayers tax bill or tax liability is reduced or even brought to zero for a certain period of time and depending on various eligibility factors.

In effect a tax abatement lowers the tax liability. The tax abatement is an incentive to encourage people to redevelop and move into these areas. Taxes are compulsory contributions to the state you live in and to the federal government levied by the government to pay for things that society as a whole needs but people cant pay for individually.

A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property. They are granted by the city and can provide full or partial relief from property and other taxes for a specified period of time. Most owners of houses will be required to pay property taxes that are commonly from 1 to 3 of the value of the house every year.

Property tax abatements are offered by some cities in the form of programs that reduce or eliminate property tax payments on qualifying property for a set amount of time to be determined on an individual case basis. This makes sense because the legal definition of abatement is a reduction suspension or cessation of a. It is offered by entities that impose taxes on property owners.

What Does Tax Abatement Mean. There are different forms of tax abatement that might ease the burden on a taxpayer but they have one thing in common. This period is typically extended to between 5 and 10 years.

You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. A sales tax holiday is another instance of tax abatement. The primary purpose for this new requirement is to provide.

These incentives provide considerable savings for individuals and companies. This relief period frees up a companys capital so that it may be used to purchase. Governments use abatements as an.

Definition of tax abatement. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. A reduction in the amount of tax that a business would normally have to pay in a particular.

The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. Tax abatement is a financial incentive for the buyer. Who Receives a Tax Abatement.

In some instances an abatement can also result in a reduction of penalties imposed. IRS Definition of IRS Penalty Abatement. A homestead exemption is an exemption from paying property taxes.

That includes everything from the roads you drive on to law enforcement to the salary of the President of the United. Buying property is rarely cheap. In other words when a taxpayer is eligible for tax abatement the taxpayer will get tax relief for a.

For example John Doe owns a house and owes 4000 in property taxes for the year. A reduction of taxes for a certain period or in exchange for conducting a certain task. Penalty abatement removal is available for certain penalties under certain circumstances.

A tax abatement is a government incentive that can lower or cut property taxes in a certain area. In broad terms an abatement is any reduction of an individual or corporations tax liability. More from HR Block.

Taxes in a nutshell. Tax abatements typically take the form of a decrease in the amount of tax owing or a rebate being issued. Tax abatement on property is a major savings.

A property tax abatement is a reduction in the amount of taxes that you have to pay. An amount by which a tax is reduced. Tax-abatement as a means A temporary suspension of property taxation generally for a spe-cific period of time.

That said the same owner may qualify for a tax exemption on one property and not on another. For more information contact your local government or tax office. Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying.

A tax abatement is a reduction in the amount of taxes a business or individual must pay to the federal state or municipal levels of government. For instance local governments may offer abatements to cover the cost of building new infrastructure to incentivize development or. Tax abatement on property is a major savings.

An abatement is a reduction or an exemption of a tax for an individual or a company.

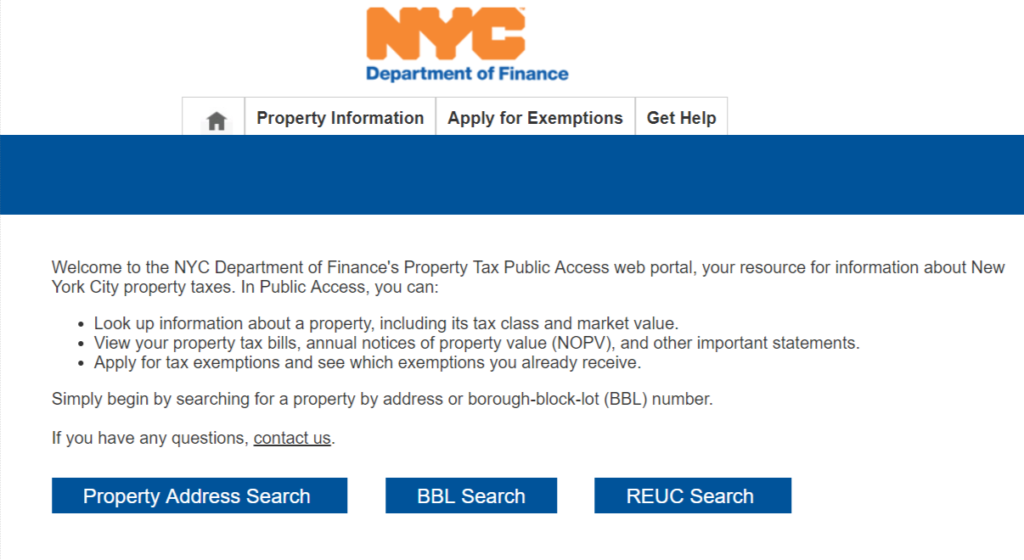

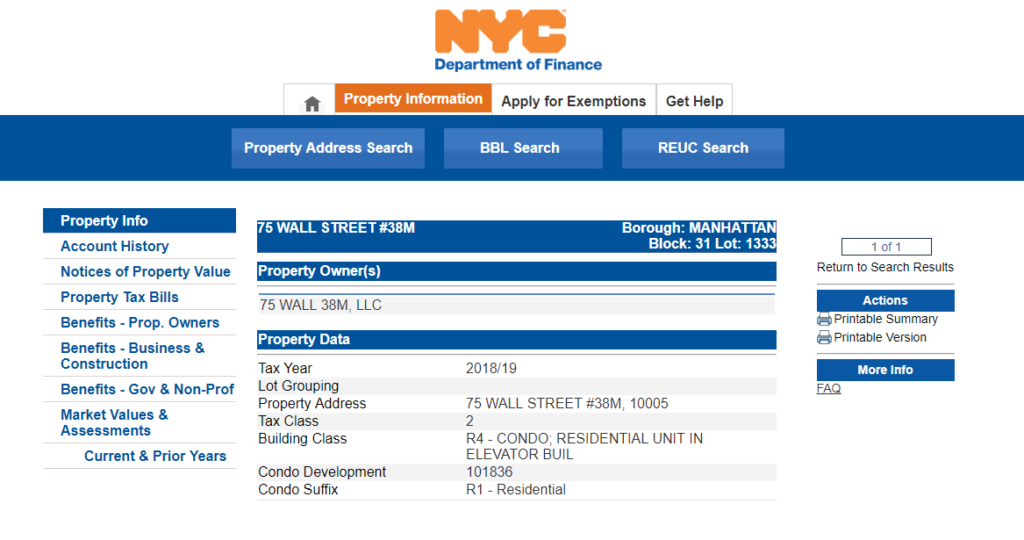

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Define Abatement Definition Of Abatement

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Solar Property Tax Abatement Form Pta4 Explained Sologistics

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit